Imagine making $40 million in one year. Would it be enough? Unfortunately for some, it’s never enough. Nicholas Cage made that amount yet found himself declaring bankruptcy, according to AARP. Was it an issue of not earning enough? Of course not! It was an issue of spending and increasing his lifestyle with the increasing income.

Even those with high incomes can get stuck in the rat race when consumption goes up in tandem with an increasing income. The income must stay high to support the lifestyle. It’s tempting to do this and I totally understand the appeal. But one of the easiest ways to get yourself on a speeding up treadmill is to fall victim to lifestyle inflation. Each time you get a raise or a bonus, it’s spent to increase your lifestyle. A nicer car, a bigger home, nicer restaurants…you get the idea.

But what if you smooth out your lifestyle, rather than experiencing the ups and downs? What if you fight the urge of lifestyle inflation and instead prioritize financial freedom through saving and investing?

Let’s see what the impact would be! Since everyone’s income and career will look different, let’s use the median household income by age (Statista) to illustrate.

15-24 – $43,531

25-34 – $65,890

35-44 – $80,743

45-54 – $84,464

55-64 – $68,951

65-74 – $43,696

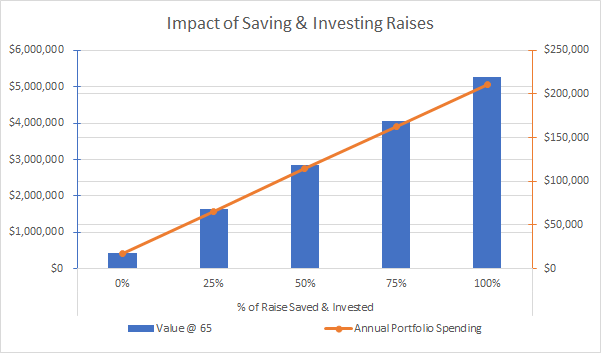

Assume you start working at the age of 22 and retire at 65. Initially you save 5% of your starting salary ($2,177). Also assume the money is invested and earns 6%. What happens though when you save and invest the raises throughout your career? Or even just a portion of those raises?

Save 0% of Raises: By the time you’re 65 you’ll end up with roughly $435,000. Using the 4% rule, this could provide annual income of roughly $17,000. That’s definitely not enough!

Save 25% of Raises: By 65 you’ll end up with roughly $1,645,000. Using the 4% rule, this could provide annual income of roughly $66,000. Now that’s something we can work with, that’s around the average income while working.

Save 50% of Raises: By 65 you’ll end up with roughly $2,900,000. Using the 4% rule, this could provide annual income of roughly $114,000. Yes, this allows you to actually spend MORE from your savings than when you were working!

Save 75% of Raises: By 65 you’ll end up with roughly $4,000,000. Using the 4% rule, this could provide annual income of roughly $160,000. Yup, you would be able to spend roughly double your peak earning years. That’s crazy talk!

Save 100% of Raises: By 65 you’ll end up with roughly $5,300,000. Using the 4% rule, this could provide annual income of roughly $210,000. That’s one heck of an income for the average household!

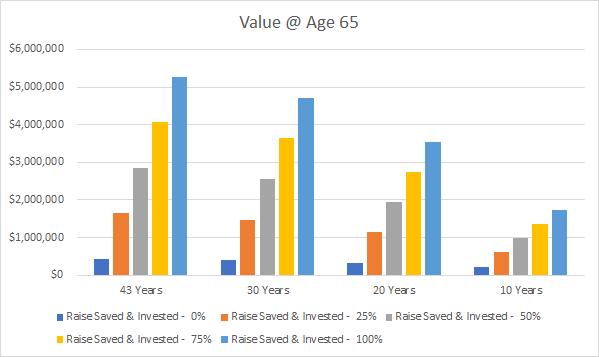

You can see that sacrificing current spending can have a profound impact when it’s invested over a long period of time. But let’s be honest, most people wouldn’t want to (or be able) to save 100% of their raises for their entire working career. Things happen, families grow and life gets more expensive. So, what is the impact if you start saving your raises at 22 but then stop? Maybe 10 years later? What about 20 or 30?

Obviously more savings will lead a larger nest egg. But there is another factor that has a profound impact…time invested. By the time you’re 65, $1 invested at age 22 will be worth MUCH more than $1 invested when you’re 40, 50 or 60. You make a much bigger impact when you save as much as you can early on. As shown above, if you invest 100% of your raises for the first 10 years of your career then stopped saving completely, you could still end up with over $1,700,000.

I could continue to dissect the data to highlight the simple way of getting ahead financially, but I’ll stop here. Important early decisions like keeping lifestyle inflation in check can have a magnified impact over time. Not everyone will want to (or can) keep their expenses really low for 43, 30 or 20 years. It’s all about finding the right balance between spending and saving. But if you’re able to, the massive grow of dollars invested early on should at least be a factor when deciding between instant gratification (spending the raise) and delaying that gratification (investing the raise) to secure financial freedom.