The first step towards being more financially independent is to reduce spending and save, which is usually the hardest part. But the next question is how to invest that money. By holding it in cash, inflation will eat away at the purchasing power. But riskier assets could be exposed during a down market. So how should one invest the cash they’ve saved?

The standard way of looking at investing is to allocate to one or many asset classes. The typical option includes cash, bonds, and stocks, in order from low return (lower risk) to high return (higher risk). Cash, in the form of a high yield savings account, should have a stable FDIC insured value. Bonds usually pay a higher rate than cash, but the value of the bonds can change. Stocks typically earn the most but can wildly swing in the short term.

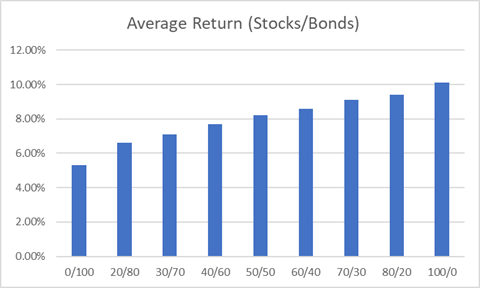

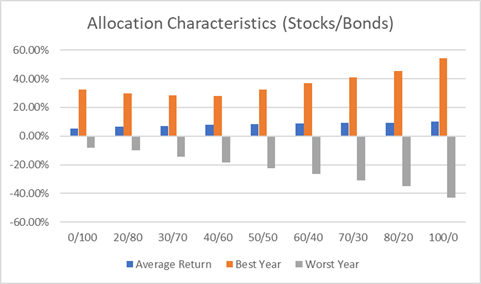

Vanguard nicely laid out some stats on mixing stocks and bonds, using data from 1926-2018. Clearly the average return goes up when investing more in stocks.

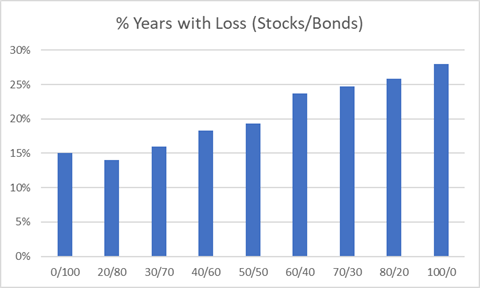

But that additional average return comes with more frequent years with losses.

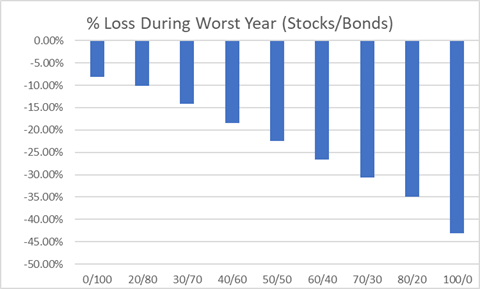

And more stocks can equate to greater losses during those years.

So obviously one needs to be careful when deciding how to invest for the future. Everyone wants to earn as much return as they possibly can, but the risk of losing money in the short term needs to be evaluated.

When deciding what to invest in, I use the goals-based approach framework. It all starts with defining future financial goals and the associated timeline. This could include a house down payment needed in 2 years, college tuition starting in 5 years or retirement 30 years out. Money needed in six months should be invested must differently than money needed 10 years out. Different asset classes like cash, bonds or stocks have their own set of pros and cons. Defining the timeline helps refine which asset classes fit the situation.

Goals a few years out:

For money needed within the next few years, I usually keep in safe assets. I prefer high yielding savings account or short term bonds. Keeping the funds safe and stable will come with the tradeoff of lower yields. Although it’s tempting to juice up returns, this money should not be gambled by being within riskier assets for only a few years. It’s not worth losing the money without having the proper time to allow it to rebound, trust me. Even certain types of bonds can be too risk. Bond prices can change for varying reasons like changes in interest rates, increased credit spreads or inflation. Investing in the stock market should be avoided to eliminate exposure to the sudden swings is can endure. It’s not worth risking a 50% decline on that down payment you need in a few years. This is why I’ve always kept the funds within safe short-term bonds or cash.

Goal is 3-5 years out:

For money needed within 3 to 5 years, I usually keep it in short or intermediate term bonds. Corporate bonds pay higher rates than treasury bonds, but they are only as good as the company paying the debt back. To obtain that higher rate, there is more exposure to credit and default risk along with the potential for credit spreads to widen. Anything that could suddenly drop in price like stocks, long term bonds or junk bonds are avoided. The principal amount invested in junk bonds (using JNK as a proxy) still hasn’t recovered from 2007! If interest rates go up, prices on long term bonds will swing down. Stocks will most likely drop if there is a recession, so it’s cutting it close with just 3 to 5 years. If it’s on the longer end of this range, there is an argument for adding a small allocation to stocks to boost returns. But know the tradeoff includes added risk.

Goal is 6-10 years out:

For money needed within the next 6 to 10 years out, I usually invest in a balance between stocks and bonds. You have the time to increase the risk and return, but only to a degree. Harnessing the higher expected returns of stocks while still allocating to safer assets can provide a complementary blend of higher return/risk and lower return/risk. I usually go for 50% stocks 50% bonds, 60/40 or 70/30 depending on if it’s closer to 6 years or 10.

Goal is 10+ years out:

For money needed 10+ years out, I usually invest in all stocks. This should yield the most return out of the three main asset classes (cash, bonds, stocks). This comes with the risk of being exposed during a sharp downturn like ‘08/’09, which took the S&P 500 about 7 years to recover. But with 10 years of time to wait things out, there should be plenty of time even with that worst-case scenario for things to recover. Patience is key on this one as the market can be sporadic and quickly pop or drop without warning.

Unknown goal with unknown timeline:

Sometimes there aren’t preset goals with a timeline and that’s okay. In this scenario, a known timeline can’t be used to determine how to invest. But I’d personally rather be invested, even if I don’t know what the timeline will be or even what the money will be used for! There are several ways, but there are usually two ways I think through this scenario. First, invest based on a guesstimate of what the timeline could be. Hopefully the timeline becomes clearer as time goes on. Second, I think about the sensitivity to two somewhat competing priorities: inflation and stability. Is it important to maintain the existing purchasing power? How important is it to maintain a stable value in the near term? If it’s kept in low yielding cash, the purchasing power will most likely be eaten away by inflation but the dollar value should remain stable. If it’s invested in higher return stocks, there is a better chance of beating inflation but the value could drop in the near term. If safety is a priority, cash or short-term bonds are used. But it’s going to be tough to beat inflation, which can be more pronounced over long periods of time. If beating inflation is a priority, a balanced between stocks and bonds or even all stocks are used. This has a better chance of beating inflation over longer periods of time. In the short term, who knows where the market will be.

This is the framework I use when investing my savings for the future. Although it might not be super exciting, investing should be closer to watching paint dry than entertainment. It should also be as systematic as possible to take out the emotion when making decisions. Using the goals-based approach helps separate dollars designated for different purposes. It also helps with finding the right balance between risk and reward depending on the goal and timeline.