It’s hard to ignore significant market drops when viewing charts of the stock market. The tech bubble’s 40% drop. The financial crisis’s 50% decline. COVID’s rapid 35% decline. My idealistic mind naturally wonders to the same thought as many others. What if I could sell right at the top, then buy near the bottom? This is a natural, even human, temptation. We all want to avoid losing what we have. But this is the very definition of market timing – attempting to sell before the market drops, then buying when the market bottoms to participate in the market rebound.

Most people have heard that it’s a bad idea to time the market. But correctly timing the market would lead to enormous gains. So why is the common narrative to ignore the innately human temptation of timing the market? Here is what you should remind yourself when that temptation comes along.

- It’s like winning the lottery, twice!

Timing the market, in essence, is trying to avoid large market drops. But knowing when a market decline will occur with 100% certainty doesn’t exist. It’s common for declines of 5%, 10%, or even 15% in a given year. Most of these are quick short-term moves. It’s extremely difficult to know, before everyone else, which one will result in major a decline. But once you’ve sold, you then have to correctly time the buy. Market bottoms are typically during the height of panic. Buying when everyone else is selling will go against every instinct. Correctly timing the sell is highly unlikely, never mind both the sell and the buy. Let me remind you that the market has recovered from every event thrown its way up to this point. Seems like the odds are pretty skewed.

2. Timing is everything

Markets can move fast, without notice. This is even more true during times of heightened uncertainty, anxiety, and panic. JP Morgan Asset Management has a great chart (see below) that illustrates this, with the average returns before and after market peaks. In essence, you have to time both the sell and the buy within months. You can sell too early and miss out on additional gains. You can buy too early and endure the very declines you sought to avoid. The COVID-19 market panic earlier this year is a great example of this. In about one month’s time, we had declined roughly 35%. Market panic had set in, with huge swings in the market. One included a 12% drop in one day. Economic activity was dropping off a cliff, we’ve never shutdown the economy on purpose. Correctly market timing this scenario would have included several logical leaps that seemed unrealistic at the time. First you would have had to predict in February that COVID-19 would shut down the economy. Assuming you sold, you only had months until the market was back at all times highs.

3. Expectations influence market prices

When a football team is heavily favored to win a game, betting lines reflect this. Bookies want people to take both sides of the bet, so the betting line will move based on expectations of who will win. The stock market is very similar. Market prices reflect investors’ expectations of future earnings. When markets are high, people are optimistic about future earnings. If the market is near the bottom, people are pessimistic about future earnings. By selling in anticipation of a market drop, you are essentially saying market expectations are wrong. Thousands of well-paid professionals spend their entire day reviewing data, analyzing market and economic data in the pursuit of finding an information edge. Large companies back these professionals with the resources to find and exploit that edge. Do you know more than they do?

4. There is always a reason to sell

What was going on during the 2009-2020 bull market that returned 377%? Large corporate bankruptcies, civil wars, debt crisis in Europe, US government shutdowns, US debt downgrade, foreign stock market crashes, oil market crash, US elections and trade wars. There will always be a reason to sell. Deciphering which headline will actually lead to a major market decline is like finding a needle in a haystack with a blindfold on.

5. I’m in a glass case of emotion!!!

Things are going to hell, I need to sell everything. The presidential candidate I hate could become president, I better get out now. The market is already down 25%, I better get out before the next 25%. Usually market timing comes in the form of an emotional decision that isn’t grounded in sound rational thinking. When our minds get in this emotional state, it’s hard to get out of that mindset. Investment decisions should be based on data and analysis, not feelings…or glass cases of emotion.

6. Opportunity costs

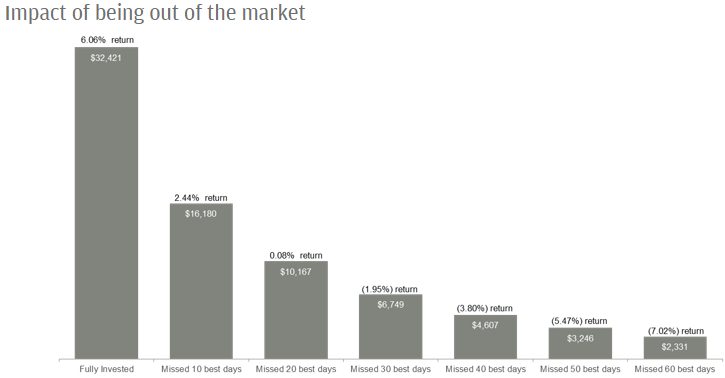

Your portfolio is like a bar of soap, the more you touch it the smaller it gets. You aren’t going to make money if you sell every time you “think” the market could go down. Large gains tend to cluster during times of market uncertainty. There is a real risk of missing out on those gains if you sell out. The below JP Morgan chart illustrates this by using data from the past 20 years. By missing out on the 10 best days, you would have half the portfolio compared to being fully invested.

Decide if you want to participate in the market or not. Success doesn’t come by selling until the dust settles. You can’t control what the market does, nor predict it’s future. Investing success comes with time in the market, not timing the market.